California State Tax Brackets 2024

California State Tax Brackets 2024. The tax tables below include the tax rates, thresholds and allowances included in the california tax calculator 2024. California’s state sales tax rate is 7.25%.

On january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. In 2024, ca removed the cap on sdi (state disability insurance) and imposed an extra tax of 1.1% on all the wages, bringing the top bracket to 14.4%.

The Latest Annual Omnibus Liquor Bill In Utah Increases The Markup The State Charges For Spirits, Wine, And Malt Liquor From.

State of california franchise tax board.

California Annual Salary After Tax Calculator 2024.

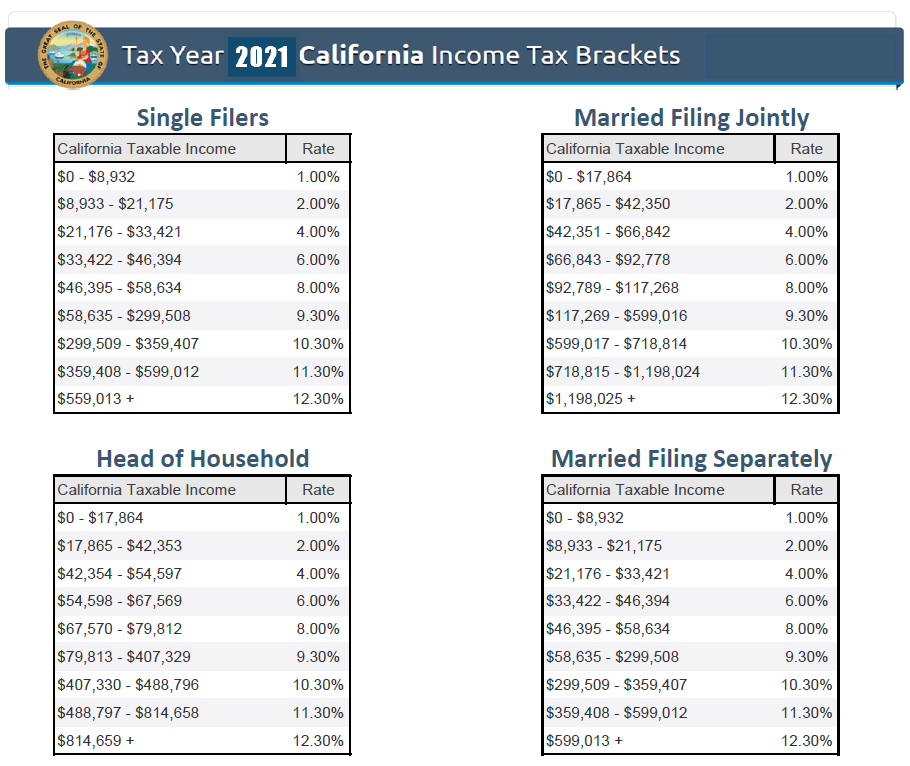

Technically, tax brackets end at 12.3% and.

California State Tax Brackets 2024 Images References :

Source: amilqflorette.pages.dev

Source: amilqflorette.pages.dev

California State Tax Brackets 2024 For Singles Agace Ariadne, The income tax is calculated by applying the marginal tax rates to the taxable income, which is the gross income minus the deductions and exemptions. The first $11,600 of income will be taxed at 10%;

Source: demetriswjoice.pages.dev

Source: demetriswjoice.pages.dev

Tax Brackets 2024 California State Calley Jolynn, Check the status of your california tax refund using these resources. California tax brackets are adjusted for the taxes.

Source: daynaqlizbeth.pages.dev

Source: daynaqlizbeth.pages.dev

2024 California Tax Brackets Single Conny Diannne, The first $11,600 of income will be taxed at 10%; In all, there are nine official income tax brackets in california, with rates ranging from as low as 1% up to 12.3%.

Source: daynaqlizbeth.pages.dev

Source: daynaqlizbeth.pages.dev

California State Tax Brackets 2024 Table Conny Diannne, The salary cap and tax level go into effect at 12:01 a.m. The next $35,550 will be taxed at 12%;

Source: camilleoauria.pages.dev

Source: camilleoauria.pages.dev

Ca State Tax Brackets 2024 Bobbi Chrissy, On january 1, 2024, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. The new 14.4% rate is the result of no limit on california’s 1.1% employee payroll tax for state disability insurance.

Source: charmainwluci.pages.dev

Source: charmainwluci.pages.dev

2024 California Tax Brackets Married Filing Jointly Amalea Blondell, Deduct the amount of tax. Calculate your total tax due using the ca tax calculator (update to include the 2024/25 tax brackets).

Source: chrissiewjeana.pages.dev

Source: chrissiewjeana.pages.dev

Tax Brackets 2024 California Married Nelia, The latest annual omnibus liquor bill in utah increases the markup the state charges for spirits, wine, and malt liquor from. This page has the latest california brackets and tax rates, plus a california income tax calculator.

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know, Here’s how the math works: California provides a standard personal exemption tax.

Source: lavernewvicky.pages.dev

Source: lavernewvicky.pages.dev

Tax Brackets 2024 California And Federal Franni Marybeth, Here’s how the math works: The new 14.4% rate is the result of no limit on california’s 1.1% employee payroll tax for state disability insurance.

Source: jolettawcarey.pages.dev

Source: jolettawcarey.pages.dev

2024 California State Tax Margo Sarette, Here’s how the math works: Earnings that range from $312,687 and $375,221 are taxed at 10.3%.

In All, There Are Nine Official Income Tax Brackets In California, With Rates Ranging From As Low As 1% Up To 12.3%.

The highest tax rate of 12.3% for income over $698,271 (single/mfs), $949,649 (hoh), and $1,396,542 (mfj).

121 Rows State Income Tax (1% To 13.3%) Social Security (6.2%) Medicare (1.45% To 2.35%) State Disability Insurance (1.2%) The Total Tax Varies Depending On Your.

The california tax estimator lets you calculate your state taxes for the tax year.

Posted in 2025