California Unemployment Tax Rate 2024

California Unemployment Tax Rate 2024. Schedule f+ provides for ui. Unemployment insurance tax rates up in 2024.

New employers pay 3.4 percent for a period of two to three years. 1y | 5y | 10y | max.

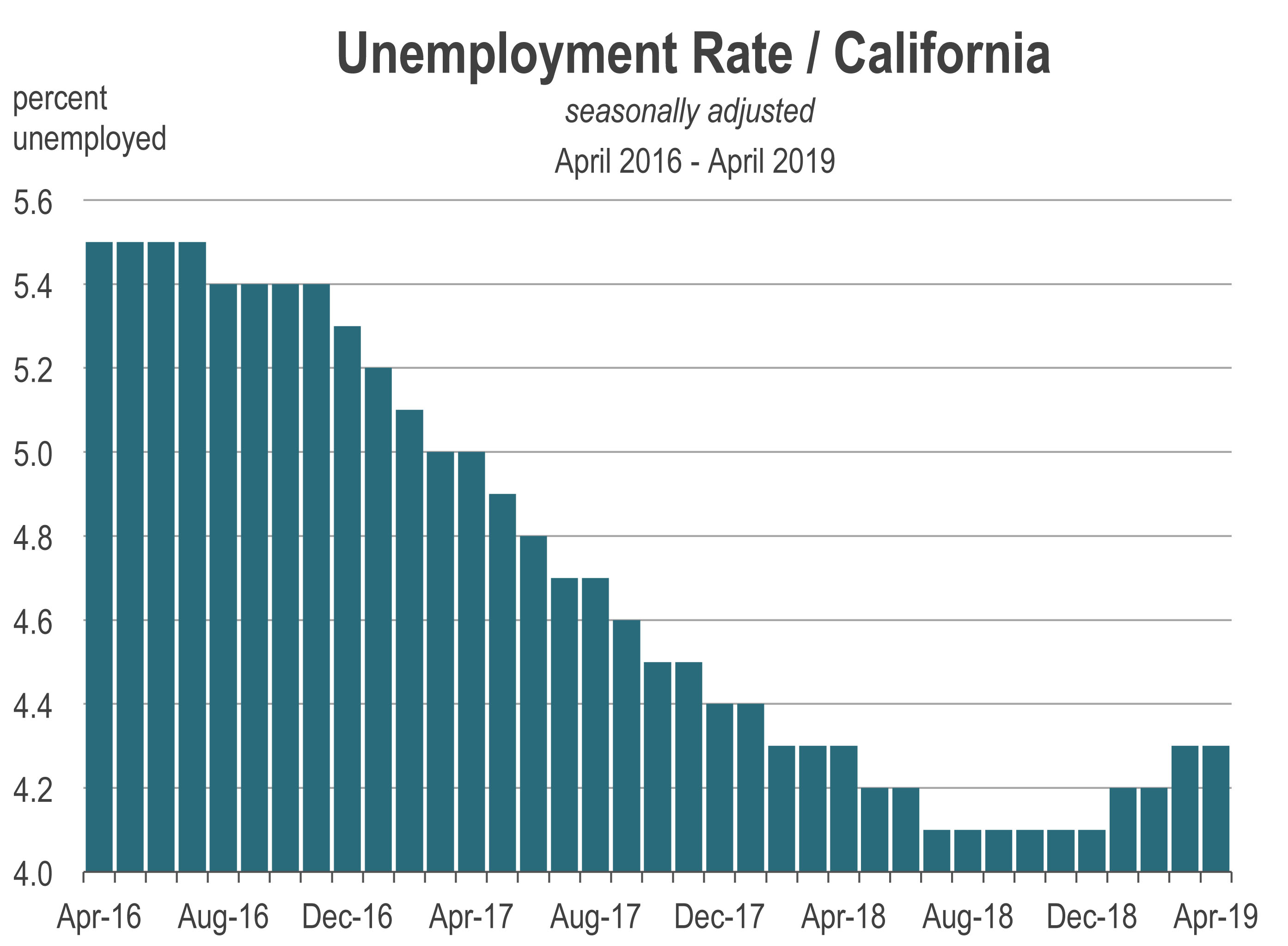

California’s Unemployment Rate Is Usually Above The U.s.

Why california needs to reform unemployment insurance funding.

New Employers Pay 3.4 Percent For A Period Of Two To Three Years.

For 2021 employers’ ui contributions were based on the.

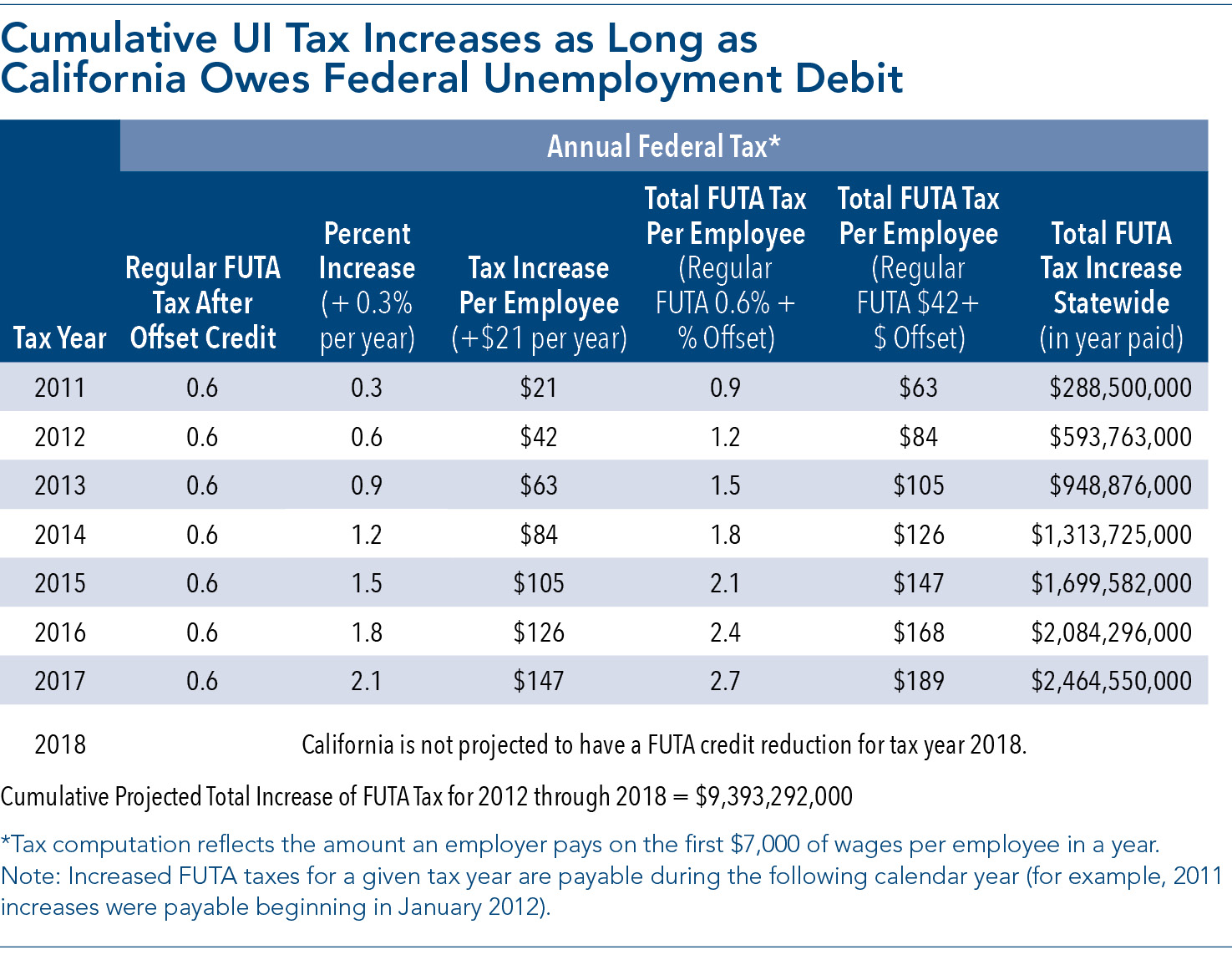

Virgin Islands, California Is Facing A Reduction In Federal Unemployment Tax Act (Futa) Credit For 2023, Which Means.

After failing to modernize the funding since 1982, california's unemployment.

Images References :

Source: californiaforecast.com

Source: californiaforecast.com

The California Unemployment Rate is Rising Again California Economic, California’s most recent unemployment rate, for january, was 5.2%. Expected to be $6.7 billion in 2023, $6.7 billion in 2024 and up slightly to $6.8 billion in 2025.

Source: bibbieqjordan.pages.dev

Source: bibbieqjordan.pages.dev

2024 California Tax Brackets Table Maren Sadella, If an employee makes $18,000 per year, their taxable wage base is $18,000, and their. An updated chart of state taxable wage bases for 2021 to 2024 (as of.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, It’s a setback for those who lost their jobs, but it hardly. The additional medicare tax of 0.9% applies to earned.

Source: calbudgetcenter.org

Source: calbudgetcenter.org

Modernizing Employer Payroll Taxes & Covering the True Costs of, Biden's budget for the 2025 fiscal year, which starts this october, includes raising the corporate income tax rate to 28% from 21%, forcing those with wealth of $100. California provides a standard personal exemption tax deduction of $ 144.00 in 2024 per qualifying filer and $ 446.00 per qualifying dependent (s), this is used to reduce the.

Source: calchamberalert.com

Source: calchamberalert.com

Federal Unemployment Insurance Taxes California Employers Paying More, This is schedule f plus a 15 percent emergency surcharge, rounded to the nearest tenth. 3efective january 1, 2024, senate.

Here's every state's unemployment rate, Unemployment insurance tax rates up in 2024. California’s most recent unemployment rate, for january, was 5.2%.

Source: taxirin.blogspot.com

Source: taxirin.blogspot.com

Ca State Unemployment Tax Rate 2020 TAXIRIN, March 8, 2024 at 9:19 am pst. Unemployment rose to 3.9% in february, the.

Source: ko.tradingeconomics.com

Source: ko.tradingeconomics.com

미국 실업률 19482022 데이터 20232024 예상, The bureau of labor statistics (bls) reported that the u.s. New employers pay 3.4 percent (.034) for a period of two to three years.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

10+ 2023 California Tax Brackets References 2023 BGH, Virgin islands, california is facing a reduction in federal unemployment tax act (futa) credit for 2023, which means. California’s unemployment rate is usually above the u.s.

Source: www.statisticsanddata.org

Source: www.statisticsanddata.org

The Unemployment Rate in U.S. States from 1980 to September 2020, Refer to publication 15, circular e, employer’s tax guide, or the irs (irs.gov). Unemployment insurance tax rates up in 2024.

New Employers Pay 3.4 Percent (.034) For A Period Of Two To Three Years.

The medicare tax rate for 2024 remains at 1.45% of all covered earnings for employers and employees.

California, Though, Should Continue To Have An Unemployment Rate Higher Than The National Average, The Forecast Said.

If an employee makes $18,000 per year, their taxable wage base is $18,000, and their.

The Ui Rate Schedule For 2024 Is Schedule F+.

The bureau of labor statistics (bls) reported that the u.s.

Posted in 2024