Tax Payment Calendar 2025

Tax Payment Calendar 2025. This comprehensive calendar covers essential deadlines for income tax filing, gst (including gstr1 and gstr3b), tds payments, roc compliance, and general. 45% of advance tax minus advance tax.

This comprehensive calendar covers essential deadlines for income tax filing, gst (including gstr1 and gstr3b), tds payments, roc compliance, and general. Click here to view relevant act & rule.

Tax Periods Determine The Tax And National Insurance Thresholds Used To Calculate Your Employees' Pay.

Here are projections for the 2025 irmaa brackets and surcharge amounts:

The Due Dates For Making The Advance Tax Payment For The F.y.

Monthly tax payment for apr 2024 under qrmp scheme

Tax Payment Calendar 2025 Images References :

Source: www.shutterstock.com

Source: www.shutterstock.com

Payment Taxes Year 2025 White Numbers Stock Photo 2167952237 Shutterstock, This also depends on what pay date you use and the pay frequency. The due dates for making the advance tax payment for the f.y.

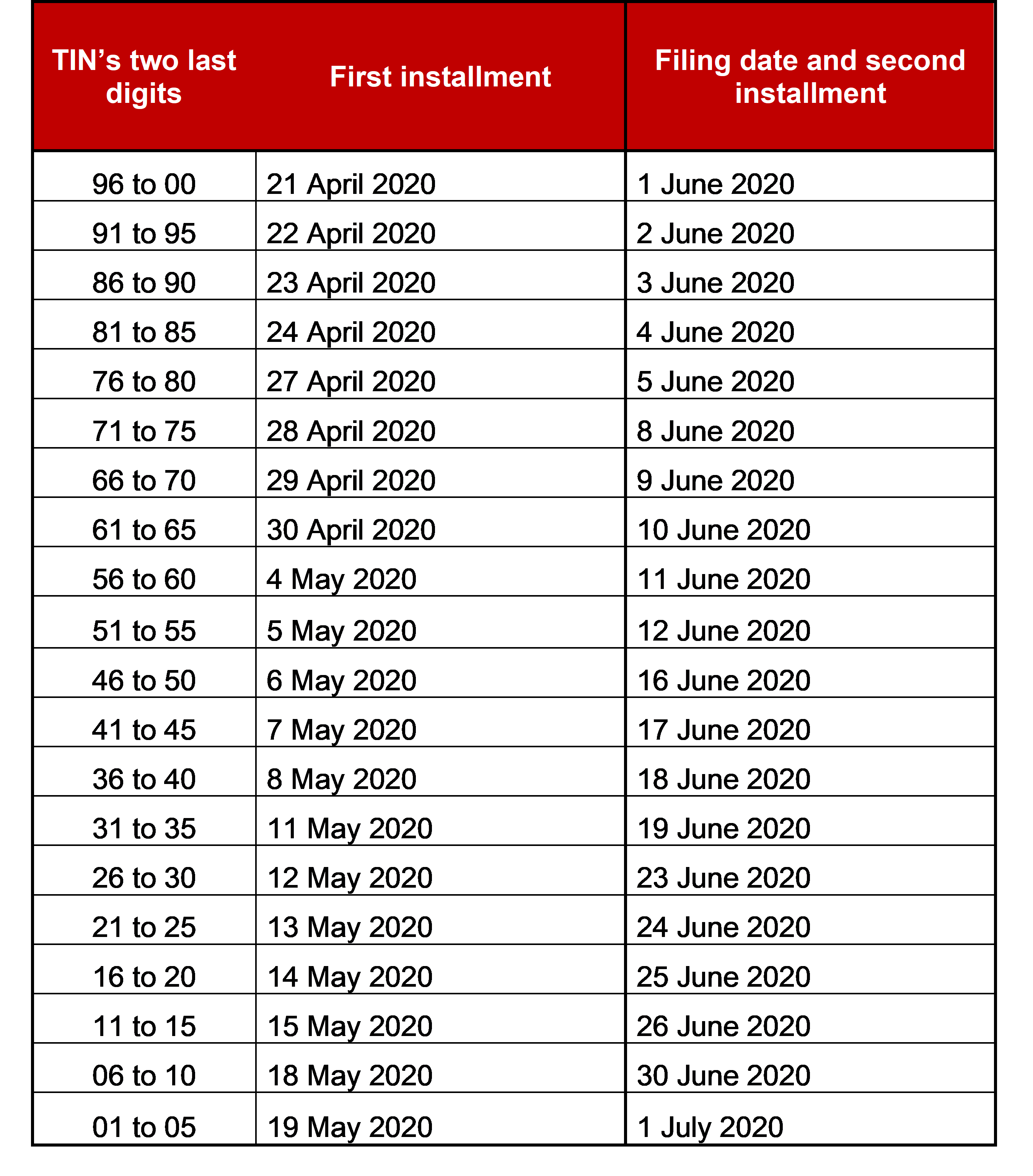

Source: carlaqmerrile.pages.dev

Source: carlaqmerrile.pages.dev

Taxes 2025 Calendar Calculator Online rebe vittoria, This also depends on what pay date you use and the pay frequency. The income tax calendar for the f.y.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Here is the income tax calendar for 2024 telling you all the important last dates between january and december 2024. Married medicare beneficiaries that file separately pay a steeper surcharge because.

Source: bu.com.co

Source: bu.com.co

Corporate Tax filing and paying due dates postponed Brigard, You can calculate your tax liability and. Last updated on 17 may, 2024.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220171 Distribution of Federal Payroll and Taxes by Expanded, This calculator will work for both old and new tax slab rates which were released in 2023 and updated in budget 2024. They ask for it in four parts, like four gifts you give them.

Source: kalender.groupe-e.ch

Source: kalender.groupe-e.ch

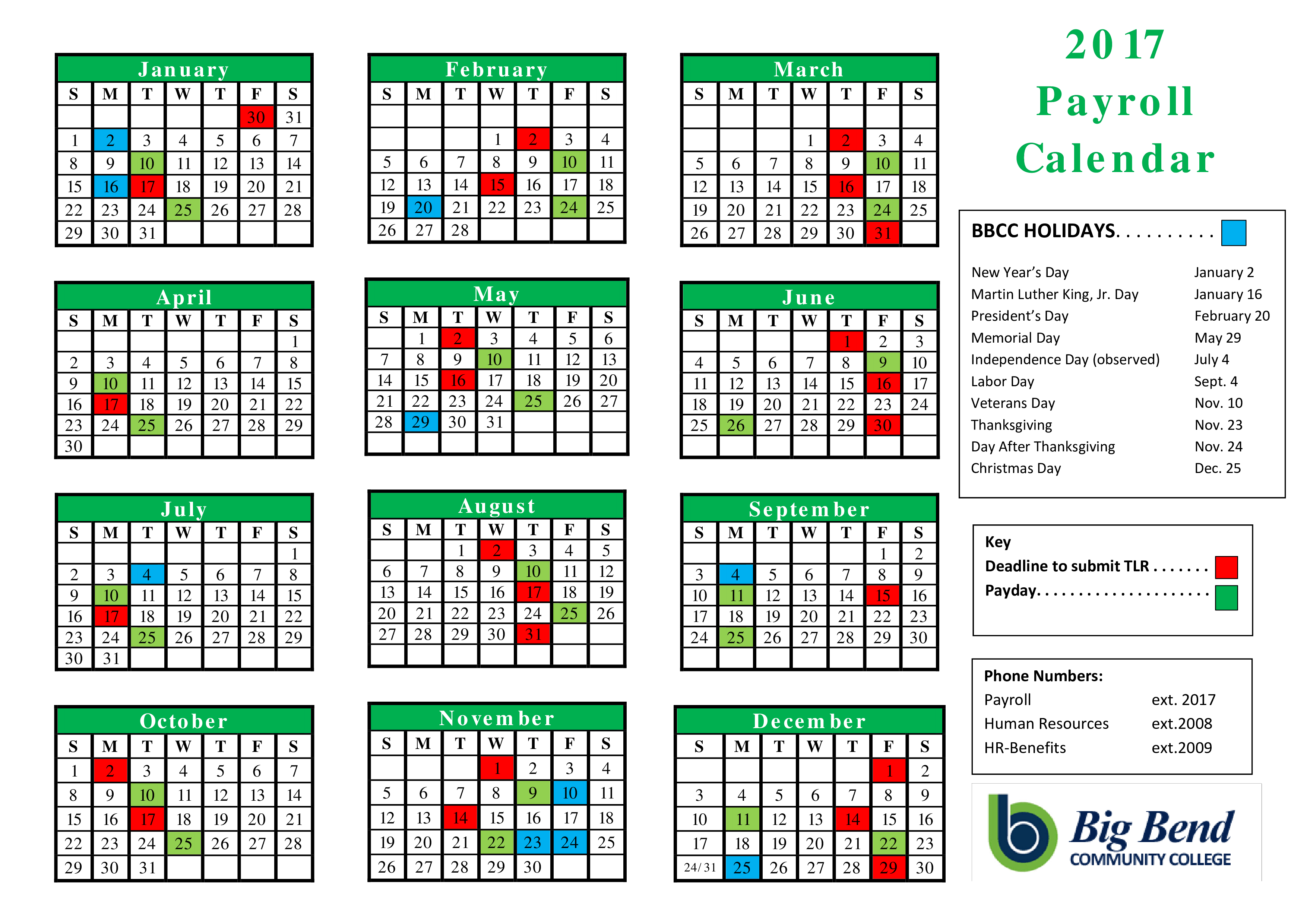

2025 Federal Pay Period Calendar Web A Payroll Calendar Can Help, July 31 is the last date to file itr. Advance tax is the income tax that is paid in advance instead of.

Source: kalender.groupe-e.ch

Source: kalender.groupe-e.ch

2025 Federal Pay Period Calendar Web A Payroll Calendar Can Help, Learn about the due dates for tds and tcs payments, returns, and consequences for late filing, deduction, and payment under the income tax act. It provides crucial dates and deadlines for submitting returns, paying.

Source: www.pdffiller.com

Source: www.pdffiller.com

Gsa Pay Calendar Fill Online, Printable, Fillable, Blank pdfFiller, Here is the income tax calendar for 2024 telling you all the important last dates between january and december 2024. This comprehensive calendar covers essential deadlines for income tax filing, gst (including gstr1 and gstr3b), tds payments, roc compliance, and general.

Source: cartoondealer.com

Source: cartoondealer.com

Taxes For The Year 2025 Concept. White Numbers On Orange Background, This comprehensive calendar covers essential deadlines for income tax filing, gst (including gstr1 and gstr3b), tds payments, roc compliance, and general. About income tax department news, notifications & calendar.

Source: mooncalendarimages2024.github.io

Source: mooncalendarimages2024.github.io

Ccsd Payroll Calendar Licensed 2024 Best Perfect Most Popular, Whether opting for taxation under section ? Income tax return deadline, tds deposit, vda tax statement.

The Income Tax Calendar For The F.y.

Married medicare beneficiaries that file separately pay a steeper surcharge because.

45% Of Advance Tax Minus Advance Tax.

Monthly tax payment for apr 2024 under qrmp scheme

Posted in 2025